Every individual harbors a profound desire to attain a state of abundant stability and prosperity. This longing for financial affluence is an inherent and unquenchable yearning within the depths of our souls. It encompasses various facets of our lives, transcending the realm of mere material wants and embracing the essence of personal fulfillment and contentment.

Embarking on the journey towards financial success requires a keen understanding of the intricate complexities that encompass wealth creation. It demands a combination of astute decision-making, unwavering determination, and an unwavering commitment to constant growth and improvement. By arming ourselves with practical knowledge and adopting a strategic mindset, we navigate the treacherous waters of economic vagaries with finesse and precision.

True financial prosperity is not merely confined to the acquisition of monetary assets; it encompasses the cultivation of a holistic approach to life. It empowers individuals to lead lives filled with dignity and autonomy, thereby enabling them to pursue their passions and contribute meaningfully to society. By leveraging our innate talents, honing our skills, and embracing diverse opportunities, we pave the way towards achieving enduring financial security and an enriched existence.

Within the tapestry of our aspirations, the pursuit of financial prosperity is a constant theme that resonates with individuals from all walks of life. It serves as a catalyst, inspiring us to transcend our limitations, overcome obstacles, and unleash our untapped potential. Ultimately, the journey towards economic abundance is not just a dream but a tangible reality waiting to be unraveled, providing us with boundless opportunities for personal growth, fulfillment, and the realization of our wildest aspirations.

Formulating Clear Financial Objectives for Long-Term Progress

Setting well-defined financial goals is an indispensable aspect of long-term prosperity. By establishing clear objectives, individuals pave their path towards achieving financial stability, independence, and security. In this section, we will delve into the significance of setting specific, measurable, attainable, relevant, and time-bound (SMART) goals. With a strong foundation of SMART financial objectives, individuals can effectively plan, prioritize, and track their progress towards long-term success.

The Significance of Specific Goals:

Defining specific financial goals is crucial in order to establish clear milestones and targets for accomplishment. Specific goals provide individuals with a concrete vision of their desired financial outcomes, allowing them to channel their efforts and resources towards achieving them. By identifying specific objectives, such as saving a certain amount of money for retirement or paying off a particular debt, individuals can create actionable plans that are tailored to their unique circumstances and aspirations.

The Importance of Measurable Goals:

Measurable goals enable individuals to track their progress and evaluate their financial achievements objectively. By quantifying objectives, individuals can identify whether they are on track, falling behind, or exceeding their desired outcomes. Measurable goals also provide a sense of accountability, as individuals can regularly assess their financial performance and make necessary adjustments to ensure they remain on the right path towards long-term success.

The Attainability of Financial Goals:

Setting attainable financial goals is crucial to maintain motivation and prevent frustration. While it is important to aim high and challenge oneself, it is equally important to ensure that goals are within reach. Attainable goals consider an individual's financial resources, abilities, and current circumstances. By setting realistic objectives, individuals can foster a sense of confidence and progress, as each milestone achieved brings them closer to their long-term financial success.

The Relevance of Goals to Long-Term Success:

Relevant financial goals align with an individual's broader vision for their financial future. They are directly related to one's financial aspirations, priorities, and values. By setting relevant goals, individuals ensure that their efforts are focused on achieving outcomes that genuinely matter to them. Relevant goals provide individuals with greater clarity, purpose, and direction, making the journey towards financial success not only fulfilling but also personally meaningful.

The Time-Bound Nature of Financial Goals:

Time-bound goals come with a specific deadline or timeline for accomplishment. By setting time-bound financial objectives, individuals establish a sense of urgency and discipline necessary for consistent progress. Alongside the establishment of time frames, individuals can also break down their objectives into smaller, manageable milestones, enabling them to stay on track and motivated throughout their financial journey.

In conclusion, formulating clear financial objectives based on the principles of specificity, measurability, attainability, relevance, and time-bound nature is the foundation for achieving long-term financial success. By setting SMART goals, individuals gain clarity, focus, and determination, enabling them to make informed decisions, overcome financial challenges, and ultimately reap the rewards of their prudent financial planning.

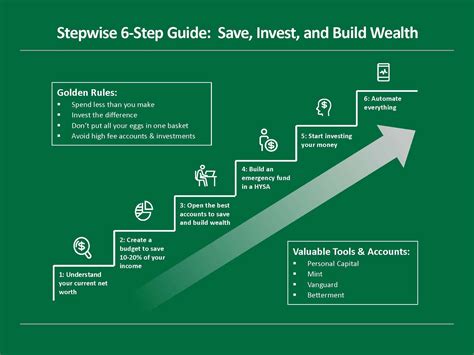

Developing a Concrete Financial Strategy for Wealth Accumulation

Creating a well-crafted financial roadmap plays a pivotal role in the pursuit of long-term economic prosperity. This section dwells on the significance of constructing a robust plan that paves the way for wealth creation, highlighting essential steps fueling financial growth.

1. Setting Clear Goals: One fundamental aspect of an effective financial plan is defining objectives that align with individual aspirations and aspirations for financial security. By setting realistic and measurable goals, individuals can structure their finances along a purposeful trajectory.

2. Budgeting and Expense Tracking: A solid financial plan necessitates meticulous budgeting and track records of expenses. Developing a comprehensive budget allows for efficient management of income, ensuring funds are allocated wisely and spent intentionally.

3. Creating an Emergency Fund: Life is prone to unexpected events, and building a contingency fund acts as a safety net during challenging times. Establishing an emergency fund helps individuals navigate unforeseen circumstances while safeguarding their overall financial stability.

4. Debt Management: Managing debt is vital for financial progression. By creating a strategic repayment plan and addressing outstanding debts, individuals can alleviate financial burdens, reduce interest payments, and improve their overall creditworthiness.

5. Investing Wisely: Executing a well-informed investment strategy enables individuals to grow their wealth over time. Diversifying investments, conducting thorough research, and seeking professional advice are crucial steps in ensuring successful investment outcomes.

6. Regular Review and Adjustments: A solid financial plan is not static; it requires periodic evaluation and necessary adjustments. Regularly assessing financial progress allows individuals to identify potential challenges, capitalize on new opportunities, and steer their wealth creation journey towards continued success.

In conclusion, developing a meticulous financial plan acts as a guiding framework for individuals to embark on a journey towards financial prosperity. By setting clear goals, implementing disciplined budgeting, managing debt, and making informed investment decisions, one can pave the way for long-term wealth accumulation.

The Art of Saving: Strategies and Tips for Building Wealth

In the pursuit of financial prosperity, the ability to save money plays a crucial role. Saving is not merely a virtuous act; it is a powerful tool that can help individuals build their wealth and achieve their long-term financial goals. Understanding effective strategies and implementing smart saving techniques can make a significant difference in one's financial journey. This section explores the power of saving and provides practical tips to help individuals pave the path to financial success.

1. Start Early and Embrace Compound InterestOne of the most powerful strategies for building wealth is to start saving early. By taking advantage of compound interest, individuals can watch their savings grow exponentially over time. Even small amounts contributed consistently can yield substantial results in the long run. | 2. Set Realistic Saving GoalsTo stay motivated and focused, it is important to establish realistic saving goals. Start by assessing your financial situation, determining your aspirations, and breaking them down into attainable milestones. By having a clear target in mind, you can better organize your finances and make informed decisions to reach your goals. |

3. Create a Budget and Track ExpensesBuilding wealth requires discipline and a conscious effort to manage expenses. Creating a budget helps in tracking income and prioritizing expenses. By identifying unnecessary spending and redirecting those funds towards savings, individuals can effectively maximize their saving potential and steadily build their wealth. | 4. Automate Saving and Invest WiselyAutomating savings by setting up regular transfers into a dedicated savings account provides a seamless way to consistently build wealth without relying on willpower alone. Additionally, exploring investment options based on risk tolerance and long-term financial objectives can further accelerate wealth accumulation. |

5. Minimize Debts and Lower ExpensesTo effectively grow wealth, it is vital to minimize debts and reduce unnecessary expenses. High-interest debts can hinder saving potential, so focus on paying off debts strategically while avoiding new ones. Additionally, evaluate recurring expenses regularly and find ways to trim unnecessary costs, enabling more funds to be allocated towards saving. | 6. Continuously Educate Yourself about Personal FinanceKnowledge is key in building and managing wealth. Continuously educating yourself about personal finance topics, such as investments, taxes, and financial planning, can help you make informed decisions and optimize your financial strategies. Take advantage of available resources, such as books, online courses, and financial advisors, to expand your financial knowledge. |

By implementing these strategies and embracing the power of saving, individuals can lay a solid foundation for their financial journey. Building wealth requires commitment, time, and dedication, but with the right mindset and informed decisions, anyone can achieve their financial aspirations and create a secure and prosperous future.

Investing Wisely: How to Build Your Wealth and Attain Financial Independence

When it comes to securing your financial future, there are few strategies as effective as wise investments. By strategically allocating your funds into profitable ventures, you can grow your wealth and gain the freedom to live life on your own terms. This section explores the key principles and tips for investing intelligently, enabling you to take control of your financial destiny.

1. Diversify Your Portfolio

One of the fundamental tenets of successful investing is diversification. By spreading your investments across various asset classes like stocks, bonds, real estate, and commodities, you mitigate the risk associated with any one investment. This approach helps protect your portfolio's overall value and increases the chances of generating consistent returns over time.

2. Understand Risk and Reward

Investing entails a delicate balance between risk and reward. While higher-risk investments can yield greater returns, they also come with a higher possibility of loss. It is crucial to evaluate your risk tolerance and financial goals before making any investment decisions. By aligning your investment choices with your risk appetite, you can optimize your returns while maintaining a level of comfort and peace of mind.

3. Keep a Long-Term Perspective

Successful investing requires patience and a long-term perspective. Markets can be volatile in the short term, but history has shown that they tend to appreciate over time. By adopting a buy-and-hold strategy, you can ride out market fluctuations and benefit from the power of compounding returns. Avoid getting swayed by short-term market noise and stay focused on your long-term financial goals.

4. Stay Informed and Seek Advice

The investment landscape is constantly evolving, and staying informed is crucial for making wise decisions. Stay updated on market trends, economic indicators, and industry news that may impact your investments. Additionally, consider consulting with financial advisors who can provide valuable insights and guidance tailored to your specific financial situation and goals.

5. Take calculated risks

While avoiding unnecessary risks is sensible, taking calculated risks can yield significant rewards. Assess potential investments carefully, conduct thorough due diligence, and analyze historical performance and future prospects. By doing so, you can identify opportunities that align with your investment objectives and make informed decisions that have the potential to generate substantial returns.

Conclusion

Investing wisely is a critical step towards achieving financial freedom. By diversifying your portfolio, understanding risk and reward, maintaining a long-term perspective, staying informed, and taking calculated risks, you can grow your wealth and attain the financial independence you desire. Remember, investing is a journey that requires ongoing learning and adaptation. Start today and build a strong foundation for a secure financial future.

Building Multiple Income Streams: Diversifying Your Path to Financial Prosperity

In the pursuit of financial prosperity, it is essential to explore various avenues to generate income. By building multiple income streams, individuals can diversify their financial journey, ensuring a more stable and resilient financial future.

| 1. Freelancing and Side Gigs | By leveraging your skills and expertise, freelancing and taking on side gigs can provide an additional stream of income. Whether it's offering freelance services in your field or pursuing a passion project on the side, these opportunities offer flexibility and the potential for significant earnings. |

| 2. Investing in Stocks and Real Estate | Investing in stocks and real estate allows individuals to grow their wealth over time. By strategically diversifying their investment portfolio, individuals can secure a steady flow of passive income through dividends, rental properties, or capital gains. |

| 3. Creating and Monetizing Digital Content | With the rise of the digital era, individuals have the opportunity to create and monetize various forms of digital content such as blogs, podcasts, videos, or online courses. By building a loyal audience and utilizing advertising, sponsorships, or paid subscriptions, creators can generate consistent income streams. |

| 4. Starting a Business | Entrepreneurship offers the potential for unlimited income possibilities. By identifying market gaps and establishing a successful business venture, individuals can create both active and passive income streams. However, this path requires careful planning, dedication, and a solid business strategy. |

| 5. Utilizing Passive Income Opportunities | Passive income opportunities, such as peer-to-peer lending, affiliate marketing, or rental income from properties, provide a regular cash flow without requiring significant ongoing effort. By carefully choosing and optimizing these opportunities, individuals can diversify their income sources and reduce reliance on active income. |

By pursuing multiple income streams and diversifying sources of revenue, individuals can create a robust financial foundation that withstands economic uncertainties and opens up avenues for long-term growth. It is important to assess personal strengths, interests, and risk tolerance when exploring these opportunities, ensuring a balanced approach to achieve financial prosperity.

Mastering the Art of Budgeting: Take Control of Your Finances and Build Wealth

In today's fast-paced world, managing personal finances has become increasingly important. By mastering the art of budgeting, individuals can gain control over their financial situation and pave the way towards long-term wealth creation. Budgeting involves creating a comprehensive plan that outlines income, expenses, savings, and investments. This strategic approach allows individuals to track their financial progress, identify areas of improvement, and make informed decisions to optimize their financial well-being.

Effective budgeting serves as a foundation for financial success, providing individuals with the tools they need to achieve their long-term goals. By carefully managing expenses and aligning them with personal priorities, individuals can ensure that every dollar is allocated wisely. Budgeting also fosters a sense of financial discipline, helping individuals resist the temptation of impulse spending and guiding them towards smarter financial choices.

An essential aspect of mastering budgeting is understanding the importance of savings. By setting aside a portion of income regularly, individuals can build an emergency fund and save for future aspirations. Effective budgeting enables individuals to identify areas where they can cut costs, such as unnecessary subscriptions, dining out, or entertainment expenses. This extra money can be funnelled into savings or investments, allowing individuals to grow their wealth over time.

Budgeting also empowers individuals to make informed decisions about their expenses, ensuring that they are spending in alignment with their values and long-term financial goals. By closely monitoring expenses and studying spending patterns, individuals can identify areas where they may be overspending or indulging in unnecessary luxuries. This self-awareness enables conscious decision-making, helping individuals make choices that align with their financial priorities.

Furthermore, mastering budgeting involves anticipating and planning for unexpected financial challenges. By creating a buffer within the budget for unforeseen expenses, individuals can mitigate the impact of emergencies and avoid going into debt. This level of preparedness instills peace of mind and provides individuals with a sense of financial security.

In conclusion, mastering the art of budgeting is essential for individuals seeking to take control of their finances and build lasting wealth. By creating a comprehensive plan, managing expenses, prioritizing savings, and making informed decisions, individuals can set themselves up for financial success. Budgeting not only allows individuals to track their progress but also instills financial discipline and enables them to align their spending with their long-term goals. Take control of your financial future by mastering the art of budgeting today!

Effective Strategies for Debt Repayment and Attaining Financial Stability

Managing debt and securing financial stability are crucial steps in building a solid financial future. By implementing smart strategies and adopting disciplined financial habits, individuals can make steady progress towards paying off their debts and achieving long-term financial stability.

1. Prioritize and Consolidate Debts:

- Identify your outstanding debts and prioritize them based on interest rates, with higher interest debts taking precedence.

- Consider consolidating multiple debts into a single loan with a lower interest rate, making it easier to manage and potentially reducing the overall interest paid over time.

2. Create a Realistic Budget:

- Evaluate your income and expenses to develop a comprehensive budget that allows for debt repayment while still meeting essential needs.

- Identify areas where you can cut expenses and redirect those funds towards debt repayment.

3. Minimize Unnecessary Expenses:

- Avoid impulsive spending and focus on purchasing only essential items.

- Consider negotiating lower interest rates or better terms on existing loans and credit cards.

- Eliminate or reduce discretionary expenses such as dining out, entertainment, and subscriptions.

4. Increase Income:

- Explore opportunities to increase your income, such as taking on a side job or freelancing.

- Invest in self-improvement to enhance your skills and qualifications, potentially leading to higher-paying job opportunities.

5. Build an Emergency Fund:

- Allocate a portion of your income towards creating an emergency fund, which will provide a safety net for unexpected expenses and prevent reliance on credit cards or loans.

- Strive to save at least three to six months' worth of living expenses in this fund.

6. Seek Professional Advice:

- Consider consulting with a financial advisor who can provide personalized guidance based on your unique circumstances.

- They can help you create a tailored debt repayment plan and offer valuable insights on financial management strategies.

By adopting these smart strategies and committing to responsible financial habits, individuals can gradually eliminate debt, restore financial stability, and pave the way for a more secure financial future.

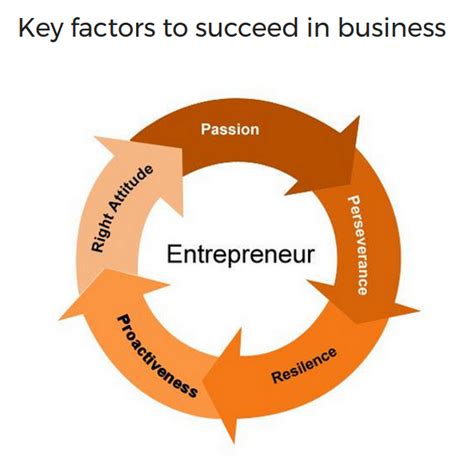

Cultivating a Mindset for Success: How Your Attitude Impacts Your Financial Journey

Developing the right mindset is crucial when it comes to achieving prosperity and abundance in your financial endeavors. Your attitude plays a pivotal role in shaping your journey towards financial success, influencing the decisions you make, and determining how you respond to challenges and setbacks along the way.

Having a positive and optimistic outlook can help you approach money matters with confidence and determination. By cultivating a mindset that embraces opportunities and sees setbacks as learning experiences, you can navigate the complex world of finance with resilience and resourcefulness.

Similarly, being proactive and maintaining a growth mindset is essential for long-term financial success. Embracing a belief that your abilities and skills can be further developed through hard work and dedication can empower you to continuously seek new opportunities and take calculated risks to achieve financial goals.

Moreover, a mindset focused on gratitude and abundance can have a profound impact on your financial journey. By recognizing and appreciating the wealth and resources you already possess, you can attract more opportunities and foster a sense of abundance that transcends mere monetary gain.

It is also important to cultivate a mindset that addresses the potential pitfalls and challenges that come with financial success. By being aware of the potential risks and taking measures to mitigate them, you can protect and grow your wealth more effectively.

In summary, cultivating a mindset for success is a vital component of achieving financial prosperity. By embracing positivity, proactivity, gratitude, and preparedness, you can navigate the world of finance with confidence, resilience, and optimism, ultimately shaping a successful financial journey.

Entrepreneurship and Achieving Financial Prosperity: Key Strategies for Launching and Expanding a Thriving Enterprise

In the pursuit of realizing your aspirations for financial success, venturing into the realm of entrepreneurship can be an extraordinary path to explore. Starting and growing a prosperous business requires careful planning, relentless dedication, and the implementation of effective strategies. This section aims to provide you with invaluable insights and practical tips to guide you on your entrepreneurial journey towards achieving substantial financial rewards.

1. Identify a Niche:

- Developing a well-defined niche is essential to stand out in a crowded business landscape.

- Researching market trends and consumer demands can help you discover unmet needs and unique opportunities.

- Identifying a gap in the market allows you to cater to a specific target audience and differentiate yourself from competitors.

2. Create a Solid Business Plan:

- Formulating a comprehensive business plan serves as a roadmap for your entrepreneurial venture.

- Define your mission, vision, and core values to set a strong foundation for your business.

- Include financial projections, marketing strategies, and operational processes to ensure a clear path towards profitability.

3. Build a Strong Network:

- Cultivating a network of mentors, advisors, and like-minded individuals can significantly enhance your chances of success.

- Attending industry events, joining business associations, and engaging in networking activities are effective ways to expand your contacts.

- Benefit from the expertise and guidance of experienced professionals who can provide valuable insights and open doors to new opportunities.

4. Embrace Innovation:

- Staying ahead in today's rapidly evolving business landscape requires embracing innovation.

- Constantly seek ways to improve your products, services, and processes.

- Explore new technologies, adopt digital marketing strategies, and adapt to emerging trends to stay competitive.

5. Manage Finances Effectively:

- Maintaining a firm grasp on your financials is vital for long-term success.

- Establish a budget, monitor cash flow, and ensure proper allocation of resources.

- Consider seeking professional advice and outsourcing certain financial tasks to experts.

6. Foster a Strong Work Ethic:

- Dedication, perseverance, and resilience are key traits of successful entrepreneurs.

- Develop a disciplined work ethic, set ambitious goals, and remain committed to achieving them.

- Embrace challenges as opportunities for growth and never shy away from hard work.

By implementing these strategies and embracing the entrepreneurial spirit, you can pave your way towards financial prosperity and achieve remarkable success in the business world. Remember, entrepreneurship is an ongoing process of growth and learning, so remain open to new ideas, adapt to market changes, and never cease your pursuit of excellence.

FAQ

How can I achieve financial success?

Achieving financial success requires a combination of hard work, determination, and smart financial planning. It involves setting clear financial goals, creating a budget, saving and investing wisely, and continuously educating oneself about personal finance. It also requires being disciplined and making smart financial decisions, such as avoiding unnecessary debt and making wise spending choices.

Is it possible to achieve financial success without a high-paying job?

Yes, it is possible to achieve financial success without a high-paying job. While a high income can certainly accelerate one's path to financial success, it is not the sole determinant. It is more important to focus on managing personal finances effectively, living within means, saving and investing wisely. By making smart financial decisions and consistently working towards financial goals, anyone can achieve financial success, regardless of their income level.

How can I get out of debt and start building wealth?

To get out of debt and start building wealth, it is important to first assess the total amount of debt and create a feasible repayment plan. This can involve cutting back on unnecessary expenses, increasing income through extra work or side hustles, and prioritizing debt payments. It is also crucial to create a budget and stick to it, allocating a portion of income towards savings and investments. Building an emergency fund can also protect against further debt in case of unexpected expenses.

What are some common financial mistakes that should be avoided?

There are several common financial mistakes that should be avoided. These include living beyond one's means, accumulating excessive debt, not investing money wisely, not having an emergency fund, and neglecting to save for retirement. It is important to avoid impulsive buying decisions, unnecessary borrowing, and not having a financial plan. It is also crucial to stay informed about personal finance and seek professional advice when needed, to avoid making costly mistakes.

How long does it usually take to achieve financial success?

The time it takes to achieve financial success varies depending on individual circumstances and goals. It is a journey that requires consistent effort and long-term commitment. Some people may achieve financial success relatively quickly if they have a high income and make sound financial decisions, while others may take longer due to lower income or setbacks. It is important to stay focused, adapt to changing circumstances, and continuously work towards financial goals to ultimately achieve success.