Think about a moment when your imagination takes flight, propelling you on a journey towards fulfilling your deepest wishes and longings. Hours spent daydreaming, visualizing all the possibilities that lie before you. In the realm of vehicular ownership, these dreams encompass more than just the acquisition of a mere mode of transportation. They represent a gateway to a world of endless opportunities, where the road stretches out in front of you, leading to new destinations and experiences.

Closely examine your motivations, for they lay the foundation upon which your dreams are built. Perhaps you yearn for a vehicle that will grant you the freedom to explore uncharted territories, to traverse winding mountain roads as the sun sets in the distance, painting the sky with hues of orange and pink. Or maybe, you seek the practical advantages of effortless daily commutes, allowing you to arrive at your destination promptly and with ease.

Whatever desires fuel your dreams, it is crucial to recognize that transforming them into reality requires meticulous planning, unwavering determination, and a deep understanding of the options available. With the right knowledge and guidance, you can navigate the intricate landscape of vehicle ownership, paving the way towards making your dreams come true.

Join us as we embark on a journey to unravel the secrets of turning aspirations into tangible possessions. Explore the different paths to vehicle ownership, examining the factors that shape your choices and evaluating the advantages and disadvantages each option presents. From purchasing brand new vehicles boasting the latest technology and design, to considering the benefits of pre-owned cars loaded with character and history, our comprehensive guide will equip you with the insights you need to make informed decisions.

Evaluating Your Financial Position

Understanding your financial situation is a crucial step towards turning your aspirations into reality. This section focuses on assessing your current financial standing and identifying the areas that need attention to achieve your dream of owning a vehicle.

- Review your income sources: Begin by analyzing all the income sources available to you. This includes your salary, investments, or any additional sources of income.

- Track your expenses: Maintain a detailed record of your monthly expenses to gain insight into your spending habits. Categorize them into essentials, such as housing and utilities, and non-essentials, such as dining out or entertainment.

- Calculate your savings: Determine your monthly savings by subtracting your expenses from your income. This will give you a clear picture of how much you can potentially save towards your vehicle purchase.

- Assess your debt obligations: Take stock of your current debt, including loans, credit card balances, or any outstanding payments. Understanding your debt-to-income ratio will help you evaluate your borrowing capacity.

- Explore potential savings opportunities: Identify areas where you can cut back on expenses and allocate those savings towards your vehicle fund. This could involve reducing discretionary spending or renegotiating bills and contracts to secure better deals.

- Develop a budget: Create a realistic budget that aligns with your financial goals. Allocate funds towards your vehicle purchase while considering your other financial responsibilities.

- Consider your credit score: Recognize the importance of a good credit score when financing a vehicle. Stay updated on your credit score and work towards improving it if needed to secure favorable loan terms.

Taking the time to assess your financial situation will give you a comprehensive understanding of where you currently stand and what steps you need to take to bring your dream of owning a vehicle closer to reality. By making informed decisions and planning strategically, you can work towards achieving your goal while maintaining financial stability.

Creating a Practical Budget

When it comes to turning your aspirations of owning a vehicle into a reality, setting a realistic budget is a crucial step towards achieving your goal. Establishing a sound financial plan will ensure that your dream of owning a car does not become a burden, but rather a attainable and rewarding experience.

1. Evaluate your current financial situation: Begin by assessing your income, expenses, and any outstanding debts. This will provide you with a clear understanding of your financial standing and allow you to determine how much you can realistically allocate towards purchasing a vehicle.

- Consider your monthly income: Look at all sources of income that you receive regularly, ensuring to take into account any taxes or deductions.

- Identify your monthly expenses: List all your regular expenses, including rent/mortgage payments, utilities, groceries, transportation, and any other financial commitments. Be thorough and honest in your evaluation.

- Factor in existing debts: Take into consideration any outstanding loans or credit card balances that require monthly payments. These obligations will impact the amount you can allocate towards a vehicle purchase.

2. Estimate the total cost of vehicle ownership: Owning a car involves more than just the initial purchase price. Take into account the additional expenses associated with owning a vehicle, such as insurance, maintenance, fuel, and registration fees. Research and gather information on average costs for these aspects to accurately gauge the expenses you will incur.

3. Determine your preferred payment method: Decide whether you plan to finance the vehicle through a loan or pay in cash. If you choose to go the financing route, carefully consider the interest rates, loan terms, and monthly payments that fit within your budget. Ensure that the repayment plan aligns with your financial capabilities.

4. Set a realistic budget: Based on your financial evaluation and the estimated total cost of vehicle ownership, establish a budget that outlines the maximum amount you are willing to spend on a car. This budget should consider not only the purchase price but also the ongoing expenses associated with owning a vehicle.

- Be conservative in your budgeting: It is better to allocate a slightly lower amount than you anticipate, to account for unforeseen costs or changes in your financial situation.

- Consider long-term financial goals: Do not compromise your financial security and future goals for the sake of purchasing a vehicle. Ensure that the budget you set allows for saving, investing, and meeting other financial obligations.

By setting a realistic budget, you will be able to approach the process of purchasing a vehicle with a clear financial plan in mind. This will empower you to make informed decisions that align with your financial well-being, turning your dream of owning a car into a tangible reality.

Exploring Different Vehicle Options

In the pursuit of turning your aspirations of owning a vehicle into a tangible reality, it is essential to embark on a comprehensive exploration of various automobile options available in the market. By conducting extensive research, you can gain insights into the diverse range of vehicles that align with your preferences, requirements, and budget.

Assessing Your Needs:

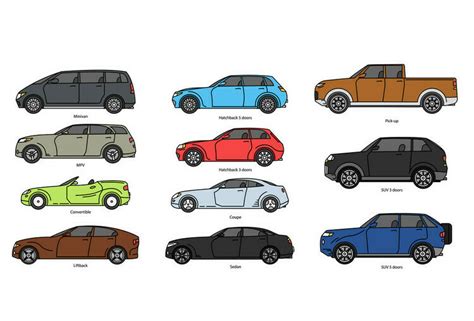

Before diving into the vast sea of vehicle options, it is crucial to identify and evaluate your specific needs and priorities. Consider factors such as the number of passengers, desired fuel efficiency, preferred body type (sedan, SUV, etc.), transmission type (manual or automatic), and any special features that are important to you, like advanced safety systems or entertainment features.

Exploring Vehicle Types:

There is an array of vehicle types available to suit different purposes and lifestyles. Whether you are looking for a compact and efficient city car, a versatile SUV for family adventures, a sleek and stylish sports car, or a sturdy pickup truck for utility purposes, researching the options that best match your desired type is essential.

Comparing Makes and Models:

Once you have identified your preferred vehicle type, it is time to delve into the extensive assortment of makes and models within that category. Compare specifications, performance, reliability ratings, safety features, and consumer reviews to narrow down your choices and find the perfect fit for your dream vehicle.

Considering Budget and Financing:

As you explore different vehicle options, it is crucial to keep your budget in mind. Researching the average prices of the vehicles you are interested in, including both new and used models, can help you determine a realistic budget. Additionally, understanding the available financing options and evaluating affordability can assist you in making an informed decision.

Test Drives and Vehicle Inspections:

Once you have narrowed down your choices, it is highly recommended to schedule test drives and thorough vehicle inspections. This hands-on experience will provide you with a better understanding of the vehicle's performance, comfort, and overall condition.

Seeking Expert Advice:

If you feel overwhelmed or uncertain during the research process, don't hesitate to consult with automotive experts or seek advice from trusted sources. They can offer valuable insights, answer your questions, and provide guidance to ensure you make an informed decision.

Conclusion:

By diligently researching different vehicle options, you can make your dreams of owning a vehicle a reality. Assessing your needs, exploring various vehicle types, comparing makes and models, considering budget and financing, test driving and inspecting vehicles, and seeking expert advice are crucial steps in making an informed and satisfying choice. So, embark on this exciting journey and discover the perfect vehicle that fulfills your dreams and aspirations!

Exploring Various Financing Options

When it comes to turning your aspirations into reality and finding the perfect means to acquire your desired mode of transportation, it's essential to familiarize yourself with the array of financing options available. In this section, we will delve into different approaches that can help you bring your dreams closer to actualization, all while considering your unique circumstances and preferences.

- Traditional Auto Loans: One of the most common ways individuals finance their vehicle purchases is through traditional auto loans. These loans are typically offered by banks, credit unions, and other financial institutions, allowing borrowers to obtain a specific amount to cover the cost of the vehicle, which is then repaid in monthly installments over an agreed-upon period.

- Leasing: Another popular option is vehicle leasing. Leasing offers the opportunity to utilize a vehicle for a predetermined period, usually ranging from two to four years, in exchange for monthly payments. It provides flexibility, as at the end of the lease term, you can either return the vehicle or have the option to purchase it at a predetermined price.

- Manufacturer Financing: Many automakers provide their own financing options, often in collaboration with financial institutions, to help individuals in acquiring their desired vehicles. These manufacturer financing programs may offer competitive interest rates, special promotions, or incentives, making them an attractive choice for prospective buyers.

- Personal Loans: If you prefer more flexibility in your financing arrangements, a personal loan might be a suitable option. With a personal loan, you can borrow a specific amount of money, which can then be used towards purchasing a vehicle. This option allows you to negotiate your terms and interest rates with the lender directly.

- Credit Cards: While using credit cards for purchasing a vehicle is less common, it can still be considered as an option, particularly if you have a high credit limit. However, it is crucial to note that credit cards often have higher interest rates compared to other financing methods, making it essential to pay off the balance promptly.

Remember, each financing option comes with its own terms, conditions, and considerations. It is vital to thoroughly assess your financial situation, research the pros and cons of each method, and consult with financial advisors or lenders to determine the best option that aligns with your goals and circumstances. By exploring the variety of financing options available, you can pave the way for transforming your dream of owning a vehicle into a tangible reality.

Understanding the Significance of Taking a Test Drive

Exploring the Importance of Experiencing a Vehicle Firsthand in Your Journey towards Owning a Car

When embarking on the exciting adventure of acquiring a new vehicle, there are countless factors to consider before making a final decision. While extensive research can provide valuable insights, there is simply no substitute for the experience of a test drive. This crucial step allows prospective buyers to gauge the vehicle's performance, comfort, and overall suitability to their individual needs.

One of the primary benefits of conducting a test drive is the opportunity to evaluate the performance of the vehicle. By sitting behind the wheel and feeling the engine's power, acceleration, and handling, potential owners can ascertain whether the car meets their expectations. Additionally, exploring factors such as responsiveness, braking, and maneuverability provides invaluable insight into the vehicle's safety features and overall driving experience.

Moreover, a test drive is a chance to explore the comfort and ergonomics of the vehicle. The interior layout, seat comfort, and overall space can greatly influence the driver's enjoyment and satisfaction. By spending time inside the car, future owners can assess the practicality and convenience of various features, ensuring that the vehicle aligns with their needs and preferences.

Another advantage of a test drive is the ability to assess the vehicle's compatibility with different road conditions. By driving on various surfaces such as highways, city streets, and uneven terrains, potential buyers can evaluate the car's performance and adaptability. Testing how the vehicle handles sharp turns, bumps, and different weather conditions can unveil any potential limitations, allowing buyers to make informed decisions based on their specific driving requirements.

Furthermore, a test drive provides an opportunity to interact with the vehicle's technology and safety features. Familiarizing oneself with the intuitive nature of the infotainment system, navigation tools, and driver-assistance technologies can contribute to a safe and pleasant driving experience. Evaluating the ease of use, accessibility, and overall functionality of these features during a test drive ensures that buyers can fully capitalize on the vehicle's innovative capabilities.

| Key Takeaways: |

| 1. Test driving a vehicle is essential to assess its performance, comfort, and suitability. |

| 2. Evaluating the engine's power, handling, and responsiveness provides valuable insights into the vehicle's driving experience. |

| 3. Assessing the comfort, ergonomics, and practicality of the car's interior layout is crucial for long-term satisfaction. |

| 4. Testing the vehicle on different road conditions allows buyers to gauge its adaptability and limitations. |

| 5. Interacting with the technology and safety features during a test drive ensures a seamless and safe driving experience. |

Assessing the Vehicle's Background and Current Condition

When considering the prospect of acquiring a new car, it is crucial to conduct a thorough evaluation of the vehicle's history and current state. By scrutinizing its past records and assessing the present condition, prospective buyers can ensure their dream investment doesn't turn into a nightmare. In this section, we will explore the importance of checking the vehicle's history and condition before finalizing any purchase.

One of the key aspects to investigate when examining a potential vehicle is its history report. By obtaining a detailed account of the car's previous owners, any reported accidents, and service records, buyers can gain valuable insight into its overall reliability and maintenance history. Ensuring that the vehicle has a clean history is essential for making an informed decision and avoiding any potential future problems.

In addition to the vehicle's history, assessing its current condition is equally paramount. Conducting a comprehensive inspection allows buyers to evaluate the physical state of the car, including the bodywork, interior, and mechanical components. By examining the exterior for signs of damage, rust, or inconsistencies, and meticulously inspecting the interior for any wear and tear, potential issues can be identified early on.

Furthermore, it is crucial to consider the car's mechanical condition through a thorough examination of the engine, transmission, brakes, and suspension. Testing key features such as the lights, windows, air conditioning, and infotainment system can provide an accurate assessment of the vehicle's overall functionality. Taking the car for a test drive is also highly recommended, as it allows potential buyers to gauge its performance, handling, and any unusual noises or vibrations.

By diligently checking the vehicle's history and condition, prospective buyers can ensure they are making a well-informed decision. Understanding the car's past and its present state empowers individuals to negotiate, confidently make a purchase, and transform their dream of owning a vehicle into a satisfying reality.

Negotiating the Price and Terms

One essential aspect of turning your aspirations into reality when it comes to obtaining a vehicle is achieving a favorable price and favorable terms. To accomplish this, it is crucial to engage in effective negotiation skills and strategies.

When it comes to negotiating the price, it is vital to approach the process with confidence and preparedness. Research and gather information about the market value and average pricing of the specific vehicle model you are interested in. This knowledge will give you the upper hand during negotiations, allowing you to make informed arguments and counteroffers.

Along with the price, negotiating the terms is equally crucial. This includes factors such as financing options, loan duration, interest rates, and additional fees. Understanding the various terms and conditions associated with the purchase will empower you to negotiate for more favorable terms that align with your financial goals and capabilities.

During the negotiation process, it is essential to maintain a respectful and professional demeanor. Effective negotiation involves active listening, expressing your needs and expectations, and finding common ground with the seller or dealership. Being open and flexible while still advocating for your interests can lead to a successful outcome that satisfies both parties.

Remember that negotiation is a skill that can be improved with practice. Don't be afraid to ask for concessions or seek alternatives if the initial terms presented are not in line with what you envision. With patience, persistence, and effective communication, you can negotiate a price and terms that bring you closer to making your dream of owning a vehicle a reality.

Considering Insurance and Maintenance Costs

When turning your automotive aspirations into reality, it's essential to take into account the financial aspects beyond the initial purchase. Understanding the implications of insurance and maintenance costs is crucial in order to make well-informed decisions and ensure the long-term sustainability of your vehicle ownership.

Insurance

Protecting your investment should be a top priority, and insurance plays a vital role in achieving that. The costs of insurance depend on various factors such as your location, driving history, type of vehicle, and coverage options. It is crucial to carefully research and evaluate different insurance providers to find the best fit for your needs.

Consider obtaining multiple insurance quotes from different companies to compare coverage levels, deductibles, and premiums. This will help you find a balance between affordability and comprehensive protection.

Maintenance

Maintaining your vehicle is essential for ensuring its longevity and optimal performance. Regular maintenance not only enhances safety but can also prevent costly breakdowns or repairs down the road. It is important to budget for routine maintenance tasks such as oil changes, tire rotations, and brake inspections.

Exploring options for extended warranties or service plans can provide added peace of mind by covering unforeseen mechanical failures or major repairs. However, it's important to consider the terms, conditions, and cost-effectiveness of such plans before making a decision.

By carefully considering both insurance and maintenance costs, you can make informed choices that align with your budget and safeguard your dream vehicle. Prioritizing these financial aspects will contribute to the overall enjoyment and satisfaction of owning your desired car while mitigating any unexpected financial burdens.

Making Your Purchase and Enjoying Your Brand New Car

Once you have realized your vision of owning the perfect automobile, it is time to turn your dreams into reality and embark on a journey of purchasing and enjoying your new set of wheels. This section will guide you through the essential steps and considerations to ensure a smooth and rewarding buying experience.

First and foremost, conducting thorough research is paramount. Take advantage of the vast resources available online and offline to explore different makes, models, and features that align with your preferences and budget. Evaluate the various options and narrow down your choices to a select few that truly resonate with you.

Once you have identified your top contenders, it is crucial to test drive each vehicle on your shortlist. This hands-on experience will provide invaluable insights into the performance, handling, and overall comfort of the car. Pay attention to details such as acceleration, braking, road noise, and seat ergonomics to ensure a perfect fit for you.

Next, delve into the financial aspect of your purchase. Determine your budget and consider financing options such as loans or leasing arrangements. Shop around for competitive interest rates, explore incentives or discounts, and calculate the long-term costs of ownership, including insurance, maintenance, and fuel expenses. It is essential to ensure that the overall financial commitment aligns with your long-term financial goals.

| Essential Steps for a Smooth Buying Experience: |

|---|

| 1. Thorough research and exploration |

| 2. Test driving potential vehicles |

| 3. Evaluating financing options and determining budget |

| 4. Considering overall long-term costs of ownership |

| 5. Making a decision and negotiating the purchase |

| 6. Enjoying your new vehicle to the fullest |

Once you have completed these essential steps, it is time to make a decision and negotiate the purchase. Be prepared to negotiate the price, explore additional perks or upgrades, and carefully review the terms of the sales contract. Don't hesitate to ask questions and seek clarification on any aspects you are unsure of. Remember, this is your dream becoming reality, so it is crucial to make an informed decision and feel confident with your choice.

Finally, as you drive away in your brand new car, remember to savor the exhilaration of the moment and enjoy every mile ahead. Embrace the freedom, convenience, and lifestyle that owning a vehicle brings. Take good care of your investment, follow maintenance schedules to ensure optimal performance, and create unforgettable memories as you embark on unforgettable journeys with your dream car.

FAQ

What are some tips for saving money to buy a car?

There are several ways to save money for purchasing a vehicle. Firstly, you can set a budget and make a monthly saving goal. Secondly, you can cut down on unnecessary expenses such as dining out or shopping excessively. Additionally, you can consider getting a part-time job or finding ways to earn extra income. Lastly, you can explore options like buying used cars or taking advantage of low-interest loan offers.

How can I determine the right type of vehicle for my needs?

Choosing the right type of vehicle depends on your specific needs and preferences. You should consider factors such as the number of passengers you usually carry, the purpose of the vehicle (e.g. commuting, family trips, off-roading), fuel efficiency, storage space, and safety features. It is also advisable to research different car models and read reviews to get a better understanding of their performance and reliability.

What are some important factors to consider when purchasing a used car?

When buying a used car, it is crucial to check its overall condition, mileage, maintenance history, and whether it has been involved in any accidents. You should also take the vehicle for a test drive to assess its performance. Additionally, it is a good idea to have a trusted mechanic inspect the car before making the purchase. Lastly, do thorough research on market prices to ensure you are getting a fair deal.

Is it better to lease or buy a car?

Deciding whether to lease or buy a car depends on your personal circumstances. If you prefer driving a new car every few years and enjoy having lower monthly payments, leasing might be a good option. On the other hand, if you plan to keep the vehicle for a longer period of time and want to eventually own it, buying would be more suitable. It is important to consider factors like budget, usage, and your long-term plans before making a decision.

What are some common mistakes to avoid when purchasing a vehicle?

When buying a vehicle, it is important to avoid common mistakes such as not setting a budget, failing to research on different car models and prices, not considering the long-term costs of ownership (e.g. maintenance, insurance, fuel), and skipping a thorough inspection and test drive. Another mistake to avoid is falling for high-pressure sales tactics and not negotiating the price. By being well-prepared and informed, you can avoid these mistakes and make a more confident purchase.