Have you ever found yourself lost in a world of endless possibilities, imagining a place that perfectly encapsulates your wildest desires and aspirations? A sanctuary where your every wish becomes a reality, and where comfort and luxury intertwine seamlessly.

This powerful reverie, the yearning for a space that is uniquely yours, resonates with individuals around the world. It is an inherent desire, deeply rooted in our souls, to build a haven that reflects our true selves and becomes a testament to our journey through life.

The quest for the perfect dwelling goes beyond simply finding a house; it is a pursuit of a manifestation of our dreams and a tangible representation of our accomplishments. It is the canvas upon which we paint the narrative of our lives.

Imagine a place that resonates with your heart, a structure that embodies your values and passions, and a refuge that withstands the tests of time. This is more than a place to rest your weary body; it is a space that invigorates your spirit and fuels your ambitions.

The Significance of Possessing a Dwelling

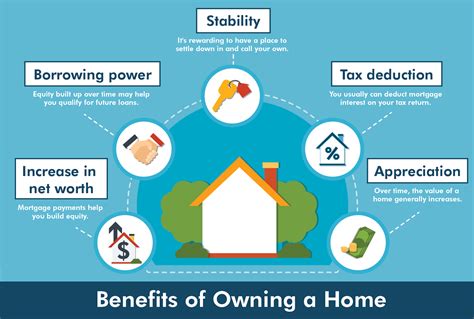

Having a place to call your own and create a sanctuary is of immense importance. It offers stability, security, and a sense of belonging. A residence signifies a personal retreat, providing an individual or a family with a space to express their uniqueness, live their dreams, and create lasting memories.

Owning a home:

| A dwelling:

|

Having a place to call home is not only about having a physical structure, but it also represents a significant emotional investment. It is a place where one can truly be themselves, surrounded by their cherished belongings and personal treasures. Homeownership empowers individuals and families to create a haven that reflects their unique personalities, values, and aspirations.

Furthermore, owning a home nurtures a sense of stability and security. It eliminates the uncertainty of changing rental agreements and the possibility of sudden displacement. With a home of their own, individuals can establish roots within a community, forging connections and contributing to the social fabric.

Financially, owning a home can present numerous benefits. It offers the potential for equity and appreciation over time, providing a valuable asset that can be leveraged for future endeavors. Additionally, homeownership enables individuals to establish a sense of long-term financial stability, as monthly mortgage payments are often more predictable and can even be lower than rental costs in certain instances.

In conclusion, the importance of owning a home goes beyond the physical structure itself. It encompasses emotions, personal growth, and financial stability. A home becomes a sanctuary where dreams are nurtured, relationships flourish, and a lasting legacy can be built. It is an integral part of human existence, adding value to both individuals and communities alike.

Stability and Security

In this section, we will explore the fundamental aspects that contribute to a sense of stability and security in the pursuit of one's ideal living space. It encompasses a range of factors, including financial well-being, physical safety, and emotional comfort. The significance of stability and security cannot be overstated, as they form the foundation upon which dreams of an ideal home can be realized.

- Financial Stability: Financial security is an essential element when envisioning your perfect dwelling. It involves having a stable income, reasonable expenses, and the ability to meet mortgage or rent payments without strain. A solid financial foundation provides peace of mind and allows for long-term planning and investment in your home.

- Physical Safety: Ensuring a safe living environment is crucial for your dream home. This includes features such as sturdy construction, effective security systems, and well-lit areas. Feeling protected from potential hazards and threats fosters a sense of security, allowing you to fully enjoy and relax in your own space.

- Emotional Comfort: Creating a home that provides emotional comfort is equally important. This involves designing a space that reflects your personality, values, and tastes, allowing you to express yourself freely. Additionally, a supportive community, reliable social networks, and a tranquil environment contribute to a sense of emotional well-being within your home.

- Long-Term Durability: Stability is enhanced by having a home that is built to withstand the test of time. Durable materials, quality construction, and proper maintenance all play a role in ensuring your dream home remains in excellent condition for years to come. This long-term durability provides peace of mind and minimizes the need for frequent repairs or renovations.

- Sustainable Living: A sustainable home promotes stability and security by reducing environmental impact and conserving resources. Implementing energy-efficient systems, utilizing renewable materials, and embracing eco-friendly practices contribute to a future-focused approach. Sustainable living not only benefits the planet but also ensures a long-term and stable living environment for generations to come.

By prioritizing stability and security in the pursuit of your dream home, you can create a foundation that supports your well-being and allows you to thrive. These elements provide a sense of assurance, enabling you to focus on the fulfillment of your aspirations within the comfort and safety of your ideal living space.

Advantages of Homeownership in Terms of Financial Benefits

When individuals envision their ideal residence, it is often associated with an array of positive economic advantages. Owning a property can bring about various financial benefits that contribute to long-term stability and prosperity.

1. Wealth Accumulation: Purchasing a home is a strategic investment that allows individuals to build wealth over time. The value of real estate generally appreciates, offering the potential for significant returns on investment in the future.

2. Mortgage Payments as Forced Savings: Unlike renting a property, homeownership involves making regular mortgage payments. These payments contribute to building equity, which can be seen as a form of forced savings. As the mortgage is gradually paid off, individuals increase their ownership stake in the property.

3. Tax Benefits: Homeownership offers several tax advantages. Deductible expenses, such as mortgage interest, property taxes, and mortgage insurance premiums, can reduce the overall tax liability. These savings can help individuals keep more money in their pockets.

4. Stability of Housing Expenses: Rent prices often fluctuate, making it challenging to budget for monthly housing expenses. Homeownership provides stability in terms of housing costs, as mortgage payments remain relatively consistent over the long term. This predictability empowers individuals to plan their finances more effectively.

5. Borrowing Power: Homeownership can increase an individual's borrowing power. As they build equity in their property, they gain access to additional financing options, such as home equity loans or lines of credit. This financial flexibility can be utilized for various purposes, such as home improvements, education, or debt consolidation.

6. Retirement Savings: A home can serve as a valuable asset in retirement planning. Once the mortgage is fully paid off, housing costs are significantly reduced, allowing individuals to allocate more funds towards retirement savings. Additionally, individuals may consider downsizing or using a reverse mortgage to supplement their retirement income.

In summary, homeownership offers numerous financial benefits, including wealth accumulation, the ability to build equity through mortgage payments, tax advantages, stable housing expenses, increased borrowing power, and enhanced retirement savings opportunities. These advantages illustrate the significant positive impact that owning a property can have on one's long-term financial wellbeing.

Factors to Consider Before Purchasing a Property

When contemplating the acquisition of a residential dwelling, it is crucial to carefully evaluate various factors before finalizing the decision. Making an informed choice is essential for ensuring the long-term satisfaction and suitability of the chosen abode. By considering these aspects, prospective homeowners can minimize potential risks and maximize the benefits of their investment.

Location: The geographical positioning of a property is of utmost importance. Factors such as proximity to essential amenities, transportation facilities, schools, and workplaces should be assessed. Additionally, considering the neighborhood's safety, reputation, and potential for future development is essential to ensure a comfortable living environment.

Size and Layout: Deciding on the appropriate size and layout of a potential home is vital to accommodate the needs and preferences of the dwelling's occupants. Aspects such as the number of bedrooms, bathrooms, living spaces, and storage areas should be evaluated to determine whether the property aligns with the desired living standards.

Condition and Maintenance: Assessing the condition of a property is crucial to understanding its immediate and long-term maintenance requirements. Thoroughly inspecting crucial aspects such as the foundation, roof, plumbing, electrical systems, and overall structural integrity is essential to avoid unexpected expenses down the line.

Affordability: Analyzing the affordability of a property is paramount to ensuring financial stability and avoiding potential economic strain. Consider factors such as the property's purchase price, additional expenses such as taxes and maintenance costs, and the feasibility of financing options to make an informed decision.

Resale Potential: While purchasing a home is a long-term commitment, considering its resale potential is a prudent decision. Assessing factors such as the property's desirability, market trends in the area, and potential for appreciation can provide valuable insights into the future value and investment return.

Legal Considerations: Understanding and complying with legal requirements and regulations is essential when purchasing a property. Consulting with legal professionals to navigate through elements such as contracts, permits, zoning restrictions, and building codes is crucial to ensure a smooth and lawful acquisition process.

Emotional Factors: Lastly, acknowledging and considering emotional factors can contribute to making a well-rounded decision. Personal preferences, emotional attachment, and the feeling of "home" are subjective aspects that should also factor into the evaluation process.

By attentively evaluating these significant factors, prospective homeowners can make an informed decision when purchasing a property. Considering these aspects will provide guidance and clarity, leading to a home that meets personal preferences, financial capabilities, and long-term aspirations.

Location and Neighborhood

In this section, we will explore the geographical position and surrounding environment of the desired property, as well as the characteristics of the local community. The location and the neighborhood have a significant impact on the overall appeal and comfort of a potential residence.

Geographical Position: The geographical position refers to the specific placement of the property in relation to other landmarks, natural features, and transportation infrastructure. It is crucial to consider factors such as proximity to city centers, accessibility to major roads or public transportation, and the overall distance to key destinations like schools, hospitals, and shopping centers.

Surrounding Environment: The surrounding environment encompasses the natural features and physical elements present in the area. This may include the presence of parks, bodies of water, nature reserves, or even picturesque views. The quality of the surrounding environment can greatly influence the level of tranquility, aesthetics, and recreational opportunities available to residents.

Local Community: Beyond the physical attributes, the neighborhood's characteristics play a vital role in determining the desirability of a potential home. Factors such as safety, social amenities, cultural diversity, and the presence of a strong sense of community are highly relevant. It is important to assess the local community to ensure that it aligns with personal preferences and interests.

Considering the location and neighborhood when searching for a new home allows for a comprehensive evaluation of the surroundings, ensuring that the desired property not only meets practical needs but also provides an enjoyable and harmonious living environment.

Achieving Your Aspirations: Affordability and Budgeting

When it comes to transforming your visions into reality, understanding the factors of affordability and budgeting are essential. This section delves into the practical aspects of turning your dreams of owning a home into achievable goals, without compromising on quality or sustainability.

Exploring the realms of affordability entails a careful examination of your financial capability and the potential costs involved in procuring your ideal residence. It requires a systematic approach that considers various aspects such as income, savings, credit history, and current market conditions. By assessing your financial standing, you can determine a reasonable budget range that aligns with your long-term goals.

The significance of budgeting cannot be overlooked when it comes to making your dreams of home ownership a reality. Developing a comprehensive budget involves meticulous planning and prioritizing your expenses. By establishing clear financial goals and tracking your spending patterns, you can allocate appropriate funds towards your future home. This prudent financial management will provide a solid foundation for achieving your aspirations.

Moreover, exploring different financing options and understanding the associated costs and benefits is crucial. Factors such as mortgage rates, down payments, and loan terms play a significant role in determining the affordability of your dream home. Adequate research and consultation with financial experts can empower you to make informed decisions that fit within your budget.

While affordability and budgeting may seem daunting at first, they are essential elements in making your dream of owning a home a tangible reality. With careful planning and consideration, you can strike a balance between your aspirations and financial capabilities, ensuring a stable and prosperous future in your ideal abode.

Potential for Appreciation: Investing in Your Future

Exploring the possibilities for growth and prosperity, the potential for appreciation in real estate presents an exciting opportunity for individuals seeking financial stability and long-term security. By delving into the intricacies of property investment, one can unlock the potential to enhance their wealth and achieve their dreams of a comfortable future.

Uncovering Hidden Gemstones

Investing in real estate presents a unique chance to uncover hidden gemstones within the property market. By carefully analyzing market trends, identifying up-and-coming neighborhoods, and anticipating future development initiatives, individuals can discover properties with the potential for substantial appreciation over time.

Unearthing the Goldmine: Opportunities Await

Opportunities abound for those who embrace the challenge of investing in real estate. With the guidance of experienced professionals, individuals can navigate the complex real estate landscape, identifying properties that possess the innate ability to increase in value and yield attractive returns.

Cultivating Wealth through Time

Real estate investment offers the ability to cultivate wealth through time, as property values tend to appreciate steadily over the long run. By patiently tending to investments and adopting a strategic approach, individuals can harness the power of property appreciation to build a strong financial foundation for themselves and their loved ones.

Planting Seeds for Future Prosperity

Just as seeds grow into mighty trees, investing in real estate allows individuals to plant the seeds for future prosperity. By acquiring properties that show promise for significant appreciation, one can set the stage for a fruitful future, free from financial stress and filled with endless possibilities.

In conclusion, the potential for appreciation in real estate provides a pathway to a brighter and more prosperous future. By carefully examining market trends, identifying hidden opportunities, and patiently nurturing investments, individuals can unlock the potential for substantial wealth accumulation, turning their dreams into reality.

Exploring Different Housing Options

When envisioning our ideal living space, it is important to consider the various types of residences that can turn our dreams into reality. From traditional houses to modern apartments, the wide range of housing options available offers something for every individual's taste and lifestyle.

1. Detached Houses: These freestanding dwellings provide utmost privacy and space, typically featuring a yard or garden area. Whether characterized by a colonial-style architecture, a contemporary design, or a charming cottage aesthetic, detached houses offer homeowners the freedom to fully customize their living environment.

2. Townhouses: Also known as row houses or terraced houses, townhouses are usually constructed in a series, sharing walls with neighboring units. This housing option offers a balance between the privacy of a detached house and the convenience of a shared community. Townhouses often boast unique architectural styles and are an ideal choice for those seeking a sense of community while still enjoying their own space.

3. Apartments: High-rise buildings or complexes of multiple smaller units, apartments are an excellent option for urban areas or those looking for a maintenance-free living experience. Ranging from studios to penthouses, apartments can provide a wide range of amenities, such as fitness centers, swimming pools, and communal spaces, making them an attractive choice for individuals or families seeking a vibrant urban lifestyle.

4. Condominiums: Similar to apartments, condominiums offer shared living spaces within a larger building or community. However, unlike apartments, condominiums are individually owned, making them a more long-term investment option. Condos often provide additional benefits, including access to amenities like concierge services, parking facilities, and recreational areas.

5. Mobile Homes: Offering flexibility and affordability, mobile homes are transportable residences that can be placed in designated mobile home parks or privately owned land. These prefabricated homes come in a variety of sizes and styles, providing an affordable alternative for those who wish to embrace a minimalist lifestyle or have the freedom to move around with their home.

6. Tiny Houses: As the name suggests, tiny houses are compact dwellings typically ranging from 100 to 400 square feet in size. These small yet creatively designed homes offer minimalistic living spaces that promote a simpler lifestyle. Tiny houses are often built on wheels, giving homeowners the convenience of mobility while living in a cozy environment.

- Different housing options cater to a variety of preferences, needs, and budgets.

- Whether it's the spaciousness of a detached house, the community feel of a townhouse, or the convenience of an apartment, there is a perfect living space for everyone.

- Exploring the different types of homes allows individuals to envision their dream residence and find the ideal setting to turn it into a reality.

Desirable Single-Family Residences: A Place to Call Your Own

In this section, we will explore the allure and benefits of single-family homes, which are exclusive private properties that offer the utmost comfort, privacy, and independence. These residences stand out as ideal dwellings for individuals and families alike, providing a unique sense of space, security, and personalization.

Condominiums and Townhouses: The Perfect Residential Choices

When envisioning our ideal residence, we often find ourselves deliberating between various types of housing options that offer comfort, style, and convenience. Among the many choices available, condominiums and townhouses stand out as exceptional options that cater to diverse lifestyles.

Condominiums, often referred to as condos, are individual units within a larger building or complex. These residences provide a blend of privacy and community living, offering a range of amenities such as fitness centers, swimming pools, and secure parking facilities. With their compact layouts and efficient use of space, condos are perfect for individuals or small families seeking a modern and low-maintenance dwelling.

Townhouses, on the other hand, present a traditional yet sophisticated residential option. These multi-level homes often showcase unique architectural designs and are characterized by their individual entrances and attached or semi-detached layouts. Townhouse communities usually feature well-maintained common areas and shared facilities, fostering a sense of belonging and community engagement.

Both condos and townhouses offer undeniable advantages compared to detached houses. For those seeking a more urban lifestyle, condos provide easy accessibility to city amenities, cultural hotspots, and public transportation. On the other hand, townhouses offer a harmonious balance between suburban tranquility and proximity to urban conveniences.

Ultimately, the decision between a condominium and townhouse hinges on individual preferences, needs, and budget considerations. While condos offer a turnkey lifestyle with minimal maintenance responsibilities, townhouses provide a greater sense of autonomy accompanied by outdoor spaces such as gardens or patios.

Whether you are a young professional seeking a sleek urban retreat or a family longing for a comfortable suburban haven, both condos and townhouses provide exceptional options that can turn your housing dream into a reality.

Apartments and Rental Properties

Exploring the world of housing options beyond the realm of owning a home and fulfilling one's aspirations, this section sheds light on the realm of apartments and rental properties. It delves into the diverse range of accommodations available, emphasizing the advantages and convenience they offer to individuals and families alike.

Advantages of Renting:

| Types of Rental Properties:

|

Whether it's the flexibility, affordability, or the ability to explore different neighborhoods and lifestyles, the world of renting offers a multitude of options to suit various preferences and circumstances. So, if the idea of home ownership isn't for you at the moment, rest assured that there are plenty of rental properties waiting to provide you with a comfortable and fulfilling living experience.

FAQ

What are the benefits of owning a home?

Owning a home comes with several benefits. Firstly, it provides stability and security as you no longer have to worry about fluctuating rent prices or the possibility of eviction. Additionally, owning a home allows you to build equity and potentially make a profit if the value of the property appreciates over time. Furthermore, homeownership provides a sense of pride and accomplishment, as it allows you to customize and personalize your living space according to your preferences.

What steps should I take to buy my own home?

Buying your own home requires careful planning and consideration. First, you need to determine your budget and assess your financial situation to understand how much you can afford. Next, you should research the real estate market and identify the location and type of property that suits your needs. Once you have a clear idea, it's advisable to engage a real estate agent to guide you through the home buying process. They can help you find suitable properties, negotiate with sellers, and handle the paperwork. Lastly, you will need to secure a mortgage loan from a bank or financial institution, ensuring you have the necessary down payment and meeting the loan requirements.

Is it better to rent or buy a home?

The decision between renting and buying a home depends on your personal circumstances and goals. Renting offers flexibility, as it allows you to easily move to a new location or downsize if needed. It requires less upfront financial commitment and is often more suitable for individuals with uncertain or transient lifestyles. On the other hand, buying a home provides long-term stability and investment potential. If you plan to settle down and have the means to afford a mortgage, buying can be a more financially rewarding option in the long run.

What factors should I consider when choosing a neighborhood to buy a home?

When choosing a neighborhood to buy a home, there are several factors worth considering. Firstly, assess the safety and security of the area by researching crime rates and talking to local residents. Secondly, evaluate the proximity to essential amenities such as schools, medical facilities, grocery stores, and public transportation. Additionally, consider the neighborhood's reputation and sense of community. Look for a neighborhood that aligns with your lifestyle and offers the desired infrastructure and recreational facilities. Lastly, take into account the potential for future property value appreciation and the overall market conditions in the area.

How can I finance the purchase of my dream home?

Financing the purchase of your dream home typically involves obtaining a mortgage loan. To finance your home, you will need to approach banks or financial institutions that offer mortgage options. They will evaluate your creditworthiness, income, and financial documents to determine the loan amount you qualify for. It's advisable to compare different lenders and their interest rates, repayment terms, and associated fees to find the best mortgage deal. Additionally, you may need to provide a down payment, which is typically a percentage of the property's value, to secure the loan. It's essential to plan your finances carefully and ensure that you can comfortably afford the monthly mortgage payments.

Is it possible to turn my dream of owning a home into reality?

Absolutely! With proper planning and financial management, anyone can achieve the dream of owning their own home. It may require saving money for a down payment, improving credit scores, and exploring different loan options, but it is definitely possible.