In the pursuit of a life filled with abundance and prosperity, one often finds themselves dreaming of a future where all their financial goals become a tangible reality. The yearning for wealth and success permeates our society, igniting a fire within individuals to unlock the mysteries that lie behind the elusive concept of financial triumph. Countless individuals embark on a journey to uncover the secrets to achieving material prosperity, seeking guidance and understanding to navigate the intricate web of wealth creation.

As we delve into the complexity of the financial realm, it becomes apparent that there is no singular formula or blueprint that guarantees a person's ascendancy to riches. Rather, one must cultivate a holistic approach, combining both strategic planning and an unwavering perseverance to overcome the obstacles that may impede their path towards affluence. It is an interplay of knowledge, adaptability, and resourcefulness that ultimately leads individuals towards the realization of their financial dreams.

Within the vast landscape of financial success, it is paramount to acknowledge the significance of cultivating a mindset attuned to abundance. The power of positive thinking and self-belief cannot be understated, as the foundation of any journey towards prosperity is rooted in one's faith in their own capabilities. By embracing an optimistic outlook, individuals empower themselves to face challenges head-on, viewing setbacks as valuable opportunities for growth rather than insurmountable barriers. This unwavering belief acts as a driving force, propelling individuals forward as they navigate the unpredictable tides of the financial world.

Moreover, it is imperative to recognize the value of strategic planning and the cultivation of financial intelligence. A judicious allocation of resources, be it time, money, or energy, is essential in propelling one's financial trajectory towards success. Skillful navigation and proficiency in investment opportunities, diversification of income streams, and prudent risk management tactics form the bedrock upon which financial prosperity can be built. Acquiring and honing the skills necessary to adapt and thrive in an ever-evolving economic landscape unlocks the door to a world of seemingly infinite possibilities.

The Mindset That Paves the Path to Achieving Financial Prosperity

When it comes to attaining financial abundance, the journey begins with a certain state of mind, a mindset that sets the stage for success. This mindset, characterized by a combination of determination, goal-oriented thinking, and strategic decision-making, acts as a key catalyst for individuals seeking to unlock the doors to financial prosperity.

Embracing a Visionary Outlook:

One essential element of the wealthy mindset is having a visionary outlook. Visionaries possess the ability to envision the possibilities that lie ahead and use them as a driving force to propel themselves forward. By cultivating this forward-thinking perspective, individuals gain the clarity needed to set ambitious goals and create a roadmap towards financial triumph.

Fostering Perseverance:

In the pursuit of financial success, setbacks and obstacles are inevitable. However, individuals with a wealthy mindset embrace these challenges as opportunities for growth. Rather than becoming discouraged, they view obstacles as valuable learning experiences and use them to refine their strategies and elevate their chances of achieving their financial goals.

Cultivating Financial Literacy:

A wealthy mindset encompasses a strong commitment to financial education and continuous learning. Understanding the intricate aspects of personal finance, investment strategies, and wealth-building techniques is crucial for individuals aiming to accumulate and preserve their wealth. By cultivating financial literacy, individuals gain the confidence and knowledge required to make informed decisions and seize lucrative opportunities.

Embracing a Positive Mindset:

The power of positivity cannot be underestimated when it comes to achieving financial success. Individuals with a wealthy mindset understand the correlation between their thoughts and actions. By nurturing a positive mindset, they attract abundance and prosperity, reinforcing their motivation to overcome challenges and persevere towards their aspirations.

Fostering a Growth-Oriented Mentality:

A growth-oriented mentality lies at the core of the wealthy mindset. Instead of fixating on short-term gains, individuals with this mindset focus on long-term success. They embrace continuous learning, seek out opportunities for personal and professional growth, and are not afraid to step outside their comfort zones. This mentality allows them to adapt and evolve as a means to achieve financial fulfillment.

In conclusion, a wealthy mindset is the foundation upon which individuals build their path to financial success. By cultivating a visionary outlook, embracing perseverance, nurturing financial literacy, adopting a positive mindset, and fostering a growth-oriented mentality, individuals unlock the doors to wealth and abundance.

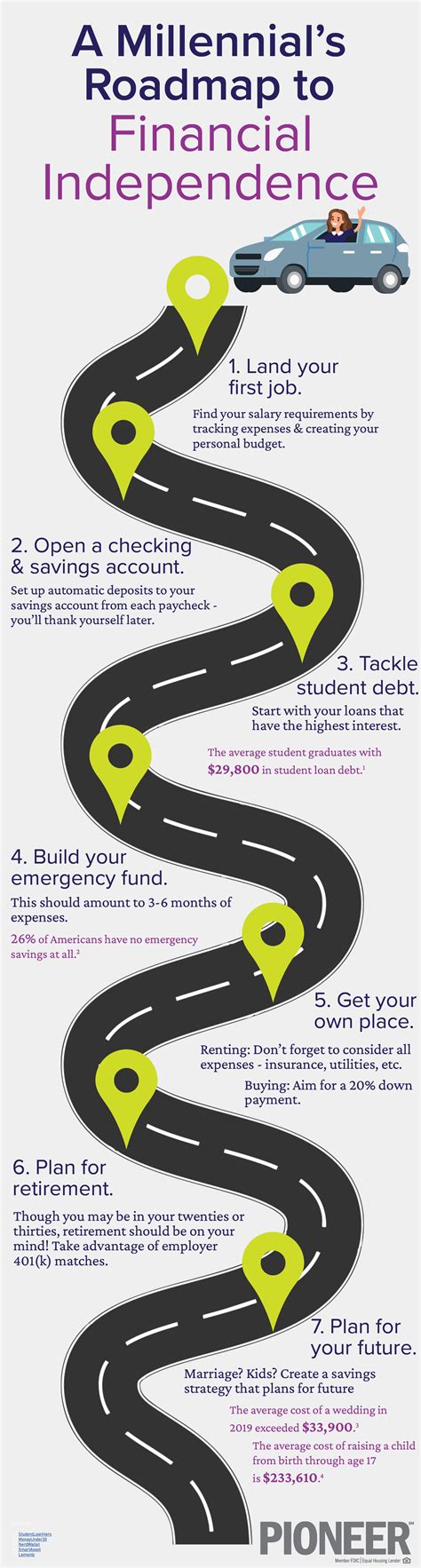

Setting Clear Financial Objectives for Achieving Prosperity

In order to attain true financial prosperity and achieve your aspirations in life, it is essential to establish clear and measurable financial goals. These goals act as guiding principles and enable you to navigate through the path of success. To ensure effective goal setting, it is crucial to have a comprehensive understanding of your current financial position and the desirable future outcomes you seek.

A well-defined financial goal provides a sense of direction and purpose, allowing you to prioritize your efforts and allocate resources accordingly. By clearly stating your objectives, you are better equipped to make informed decisions, take calculated risks, and stay focused on pursuing opportunities that align with your financial ambitions.

When setting financial goals, it is important to consider both short-term and long-term aspirations. Short-term goals allow for immediate benefits and can boost your motivation and confidence in achieving them. On the other hand, long-term goals provide a vision for your future and guide your actions towards sustainable wealth accumulation.

An effective method for establishing clear financial goals is to make them SMART. These goals should be Specific, Measurable, Achievable, Relevant, and Time-bound. Specificity ensures that your goals are well-defined and concise, while measurability allows you to track progress and assess your performance. Achievability ensures that your goals are realistic and attainable, while relevance ensures that they align with your overall financial vision. Lastly, setting time-bound goals helps create a sense of urgency and accountability.

| Setting Clear Financial Goals Tips: |

|---|

| 1. Clearly define your financial objectives, considering both short-term and long-term aspirations. |

| 2. Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). |

| 3. Break down large goals into smaller milestones to track progress and maintain motivation. |

| 4. Regularly review and reassess your goals to adapt to changing circumstances and refine your strategies. |

| 5. Seek professional advice and guidance to enhance your understanding of financial management and goal setting techniques. |

Remember, setting clear financial goals serves as a roadmap to financial success, allowing you to efficiently manage your resources, make strategic decisions, and ultimately realize your dreams of prosperity and abundance.

The Power of Investing: Transforming Money into Assets

In today's fast-paced and ever-changing world, many individuals aspire to attain financial stability and success. While there are various paths one can take on this journey, one strategy that has proven to be immensely powerful is investing. Investing, in its essence, involves allocating funds with the intention of generating a return or accumulating wealth over time. By intelligently deploying their financial resources, individuals have the opportunity to transform their hard-earned money into valuable assets that can pave the way for long-term prosperity.

Investing is a multifaceted concept that goes beyond simply saving money or keeping it in a bank account. It involves making thoughtful decisions about where to allocate funds in order to optimize growth and generate potential income. This can be done through various avenues, such as stocks, bonds, real estate, or even starting a business. By strategically investing in these different assets, individuals can not only preserve their wealth but also watch it grow exponentially over time.

One of the key advantages of investing is the power of compounding. When money is put to work through investments, it has the potential to generate returns that can be reinvested or compounded over time. As a result, the initial investment can grow exponentially, allowing individuals to build significant wealth over the long term. This phenomenon, known as compounding, is particularly powerful when individuals start investing early in their lives, as it allows them to take advantage of the time value of money.

Furthermore, investing provides individuals with the opportunity to diversify their financial portfolio. By spreading investments across different asset classes or sectors, individuals can mitigate risk and maximize potential returns. This diversification strategy helps protect against potential losses and ensures that individuals are not overly reliant on a single investment. Instead, they can balance their risk and reward, allowing for a more stable and sustainable approach to wealth accumulation.

In conclusion, investing holds tremendous power when it comes to transforming money into assets. By intelligently deploying financial resources, individuals can unlock the potential for long-term prosperity and financial success. Investing allows individuals to harness the power of compounding, diversify their portfolio, and generate significant returns that can help achieve their dreams and goals. So, whether you are just starting on your financial journey or looking to take your wealth to the next level, consider the power of investing as a key strategy in your path to financial success.

Creating Diverse Income Sources: The Path to Financial Abundance

Exploring various avenues to generate income is a key aspect of achieving long-term financial prosperity. By diversifying our income streams, we increase our chances of achieving financial abundance and reducing the risks associated with relying on a single source of income.

One effective way to build multiple streams of income is through investment. Investing in stocks, bonds, mutual funds, or real estate allows individuals to generate passive income, which can steadily grow over time. Diversifying investments across different asset classes and sectors helps protect against market volatility and maximize potential returns.

An additional method to cultivate multiple income streams is through entrepreneurship. Starting a side business or venturing into freelancing can provide an additional source of income that complements existing employment. This allows individuals to leverage their skills, expertise, and passion to create a profitable venture while enjoying flexibility and control over their work-life balance.

Developing passive income through rental properties or royalties from creative endeavors such as writing or music is yet another avenue to explore. Real estate investments enable individuals to generate consistent rental income, while artistic pursuits like writing books or composing music can generate recurring royalties from sales and licensing.

Building a strong online presence and utilizing digital platforms is increasingly becoming a popular way to diversify income streams. Creating and monetizing a blog, YouTube channel, or podcast provides opportunities for advertising, sponsorships, and product sales. Additionally, individuals can leverage their expertise to offer online courses or consulting services, thereby generating income from sharing their knowledge.

| Benefits of Multiple Income Streams |

|---|

| 1. Financial Stability |

| 2. Risk Mitigation |

| 3. Increased Income Potential |

| 4. Flexibility and Control |

| 5. Opportunities for Growth and Learning |

In conclusion, building multiple streams of income is a strategic approach to achieving financial abundance. By embracing various income-generating avenues such as investing, entrepreneurship, passive income sources, and leveraging the digital landscape, individuals can experience financial stability, mitigate risks, and unlock their true potential for wealth and success.

Learn from the Experts: Wisdom from Successful Entrepreneurs

In this section, we delve into the valuable insights shared by accomplished business leaders who have achieved remarkable success in their respective industries. By studying their journey, strategies, and mindset, we can gain a deeper understanding of the principles and practices that contribute to financial prosperity.

- Embrace Innovation: One recurring theme among successful entrepreneurs is their commitment to innovation. They understand that progress is driven by identifying new opportunities, pioneering groundbreaking ideas, and implementing novel solutions.

- Focus on Continuous Learning: Constantly expanding their knowledge and honing their skills is another hallmark of prosperous entrepreneurs. They prioritize personal and professional growth, whether through formal education, mentorship, or independent study, recognizing the importance of staying ahead of the curve.

- Cultivate a Growth Mindset: Successful entrepreneurs possess a growth mindset, seeing challenges as opportunities for growth rather than roadblocks. They embrace setbacks, learn from failures, and adapt their strategies accordingly, knowing that resilience is a vital attribute on the path to achievement.

- Build Strong Networks: Networking and building relationships are vital components of success. Entrepreneurs who have made it acknowledge the power of connections, actively seek collaboration, and surround themselves with like-minded individuals, mentors, and industry influencers.

- Create Value for Others: Providing value to customers, clients, and society at large is a key principle for prosperous entrepreneurs. They focus on creating products or services that address specific needs, improve lives, and contribute positively to the world.

- Take Calculated Risks: Stepping outside of one's comfort zone and taking calculated risks is often a defining characteristic of successful entrepreneurs. They weigh the potential rewards against the associated risks, make informed decisions, and are not deterred by failure or setbacks along the way.

- Maintain Perseverance and Persistence: Building a successful business takes time and effort, and prosperous entrepreneurs understand the importance of perseverance. They remain dedicated to their vision, overcoming obstacles, and staying committed to their goals despite challenges or temporary setbacks.

- Emphasize Strategic Planning: Successful entrepreneurs recognize the value of strategic planning and have a clear roadmap for achieving their goals. They set ambitious yet realistic objectives, break them down into actionable steps, and consistently evaluate and adjust their strategies to stay on track.

- Value Passion and Purpose: Passion fuels success, and purpose adds direction. Thriving entrepreneurs are driven by their genuine passion for their work and a strong sense of purpose. They align their business endeavors with their values, allowing their authentic enthusiasm to propel them forward.

- Adopt a Positive Mindset: A positive mindset is a powerful tool in the pursuit of success. Successful entrepreneurs maintain a positive outlook, believe in their abilities, and visualize their desired outcomes. They understand that a positive mindset attracts opportunities and fuels motivation.

By incorporating these insights into our own journeys, we can navigate the path to financial prosperity with wisdom and resilience, guided by the real-life experiences of those who have already achieved remarkable success.

Financial Education: The Path to Prosperity

In this section, we will delve into the crucial role of financial education in attaining wealth and achieving prosperity. Having a solid understanding of financial concepts and strategies is the foundation upon which successful financial decision-making is built.

Investing time and effort in expanding our financial knowledge empowers us to make informed choices regarding money management, budgeting, investing, and wealth creation. By embracing financial education, we equip ourselves with the necessary tools and insights to navigate the complex world of finance.

Financial education enables us to develop a holistic understanding of various financial instruments, such as stocks, bonds, mutual funds, and real estate. It equips us with the skills to analyze investment opportunities and assess their potential risks and returns.

Moreover, financial education broadens our perspective on wealth accumulation, encouraging us to explore diverse avenues for income generation. It teaches us the importance of diversification, allowing us to create multiple streams of income and reduce our dependence on a single source.

Furthermore, financial education emphasizes the significance of effective budgeting, enabling us to prioritize our expenses, manage debt, and save for future goals. It helps us make informed decisions about spending, distinguishing between needs and wants, and adopting frugal practices that build financial resilience.

By investing in our financial education, we not only empower ourselves but also increase our ability to contribute to society. Financially literate individuals can make a positive impact by sharing their knowledge with others and driving economic growth through intelligent financial decisions.

In conclusion, financial education serves as the stepping stone towards attaining prosperity. It equips individuals with the knowledge and skills necessary to make informed financial decisions, explore investment opportunities, and create multiple streams of income. By embracing financial education, we embark on a lifelong journey towards financial well-being and create a better future for ourselves and our communities.

Overcoming Challenges on the Path to Financial Independence

When striving to attain financial freedom, individuals often encounter various obstacles that can hinder their journey towards success. These hurdles, which may come in different forms, require perseverance, determination, and strategic planning to overcome. In this section, we will explore some common challenges faced by individuals aspiring to achieve financial independence and discuss effective strategies to conquer them.

- Debt: Managing debt is a crucial aspect of attaining financial freedom. Whether it's credit card debt, student loans, or mortgages, debt can weigh heavily on one's finances. Developing a clear repayment plan, negotiating lower interest rates, and seeking professional assistance can help individuals regain control over their finances and eliminate debt.

- Insufficient Savings: Insufficient savings can hinder progress on the path to financial independence. Building an emergency fund and setting aside a portion of income for long-term goals, such as retirement or investments, is essential. By creating a budget and prioritizing savings, individuals can overcome the challenge of insufficient funds and work towards a more secure financial future.

- Lack of Financial Literacy: Understanding basic financial concepts and strategies is crucial for making informed decisions. Many individuals lack the necessary knowledge and skills to effectively manage their finances. By investing time in learning about personal finance, individuals can gain the confidence and tools needed to overcome this obstacle and make smarter financial choices.

- Inconsistent Income: Irregular or inconsistent income can make financial planning challenging. Freelancers, entrepreneurs, and those with commission-based jobs often face this hurdle. Creating a budget based on the average income, building multiple income streams, and setting aside funds during periods of higher income can help individuals navigate the fluctuations in income and maintain financial stability.

- Procrastination and Lack of Discipline: Overcoming financial obstacles requires discipline and consistency. Procrastination and a lack of discipline can delay progress towards financial goals. Developing good habits, setting specific and achievable financial targets, and regularly monitoring progress can help individuals stay focused and motivated, ensuring they stay on track towards financial independence.

By recognizing and actively working to overcome these obstacles, individuals can pave the way towards financial freedom. With determination, perseverance, and the right strategies, anyone can achieve their dreams of financial independence and create a more secure and prosperous future.

The Significance of Budgeting: Effectively Managing Your Finances

Understanding and implementing sound budgeting practices is a crucial aspect of achieving financial stability and prosperity. Skillful management of your money can make a substantial difference in your ability to achieve your long-term financial goals. By creating and adhering to a well-planned budget, you can gain control over your expenses, allocate funds wisely, and make informed financial decisions.

A budget serves as a roadmap for your financial journey, guiding you towards your desired destination. It enables you to evaluate your income, prioritize expenses, and track your spending habits effectively. Through budgeting, you can identify areas where you can trim unnecessary expenses, cut back on non-essential purchases, and allocate funds towards your financial aspirations.

Moreover, budgeting fosters discipline and financial mindfulness, as it requires you to allocate funds according to your income and prioritize your financial objectives. By setting realistic financial goals and aligning them with your budget, you can ensure a systematic approach to managing your money, leading you closer to long-term financial success.

A well-structured budget also enables you to prepare for unforeseen circumstances or emergencies. By allocating funds towards savings and building an emergency fund, you can create a financial safety net for any unexpected financial challenges that may arise. This level of preparedness not only provides peace of mind but also reduces the stress associated with financial uncertainty.

| Benefits of Effective Budgeting: |

|---|

| 1. Financial discipline. |

| 2. Increased control over your expenses. |

| 3. Prioritization of financial goals. |

| 4. Identification of unnecessary expenses. |

| 5. Building an emergency fund. |

In summary, the importance of budgeting cannot be overstated when it comes to managing your money wisely. It provides a structured approach to your finances, enhances financial discipline, and allows for better control over your expenses. By embracing budgeting as a vital tool, you can navigate the path towards financial success and attain your desired level of wealth and stability.

Developing a Prosperous Mindset: The Key to Sustainable Financial Abundance

In the quest for lasting financial prosperity, developing a mindset geared towards abundance is of paramount importance. This unique perspective acts as the foundation for achieving long-term wealth and achieving a comfortable financial future. By cultivating a mindset that embraces prosperity, individuals lay the groundwork for success and open themselves to endless opportunities.

One vital aspect of a prosperous mindset is the belief in one's ability to create wealth. By acknowledging and nurturing their innate talents and abilities, individuals can harness their potential to generate wealth and financial success. This mindset enables individuals to embrace challenges, view setbacks as learning opportunities, and strive for continuous growth.

Another crucial element in developing a prosperous mindset is maintaining a positive attitude towards money. Rather than viewing money as a scarce resource, individuals with a prosperous mindset perceive money as a flowing entity that can be attracted and multiplied. This opens doors to innovative thinking, allowing individuals to explore diverse avenues for generating income and creating wealth.

Furthermore, a prosperous mindset involves adopting a disciplined approach towards financial planning and management. This includes setting clear financial goals, creating effective budgeting strategies, and making wise investment decisions. By cultivating financial discipline, individuals can make informed choices that align with their long-term financial objectives, thereby paving the way for sustained wealth accumulation.

Lastly, developing a prosperous mindset necessitates the cultivation of a growth-oriented mindset. A growth mindset enables individuals to embrace change, pursue lifelong learning, and capitalize on opportunities for personal and professional development. This mindset encourages individuals to stay proactive and adaptable in the face of shifting economic landscapes, leading to enhanced financial resilience and prosperity.

In conclusion, developing a prosperous mindset is an essential component of unlocking long-term financial abundance. By embracing a belief in one's ability to create wealth, maintaining a positive attitude towards money, cultivating financial discipline, and fostering a growth-oriented mindset, individuals can pave their way towards sustainable financial prosperity. As they continue on their journey, they will unlock the true potential within themselves and attain the wealth and abundance they seek.

FAQ

What are the key secrets to achieving financial success?

Financial success can be achieved by following a few key principles: setting clear financial goals, creating a budget, saving and investing wisely, and continuously educating oneself about personal finance.

Is it possible for anyone to become wealthy?

Yes, anyone has the potential to become wealthy. While it may require hard work, dedication, and smart financial decisions, with the right mindset and strategies, anyone can increase their wealth over time.

How important is it to have a plan for financial success?

Having a plan is crucial for achieving financial success. A well-thought-out plan helps individuals stay focused, set realistic goals, and make informed decisions to grow their wealth effectively.

What are some common mistakes people make that hinder their financial success?

Some common mistakes that can hinder financial success include overspending, failing to save and invest, not having an emergency fund, and not seeking financial advice when needed. It is important to avoid these pitfalls to increase the chances of achieving financial success.